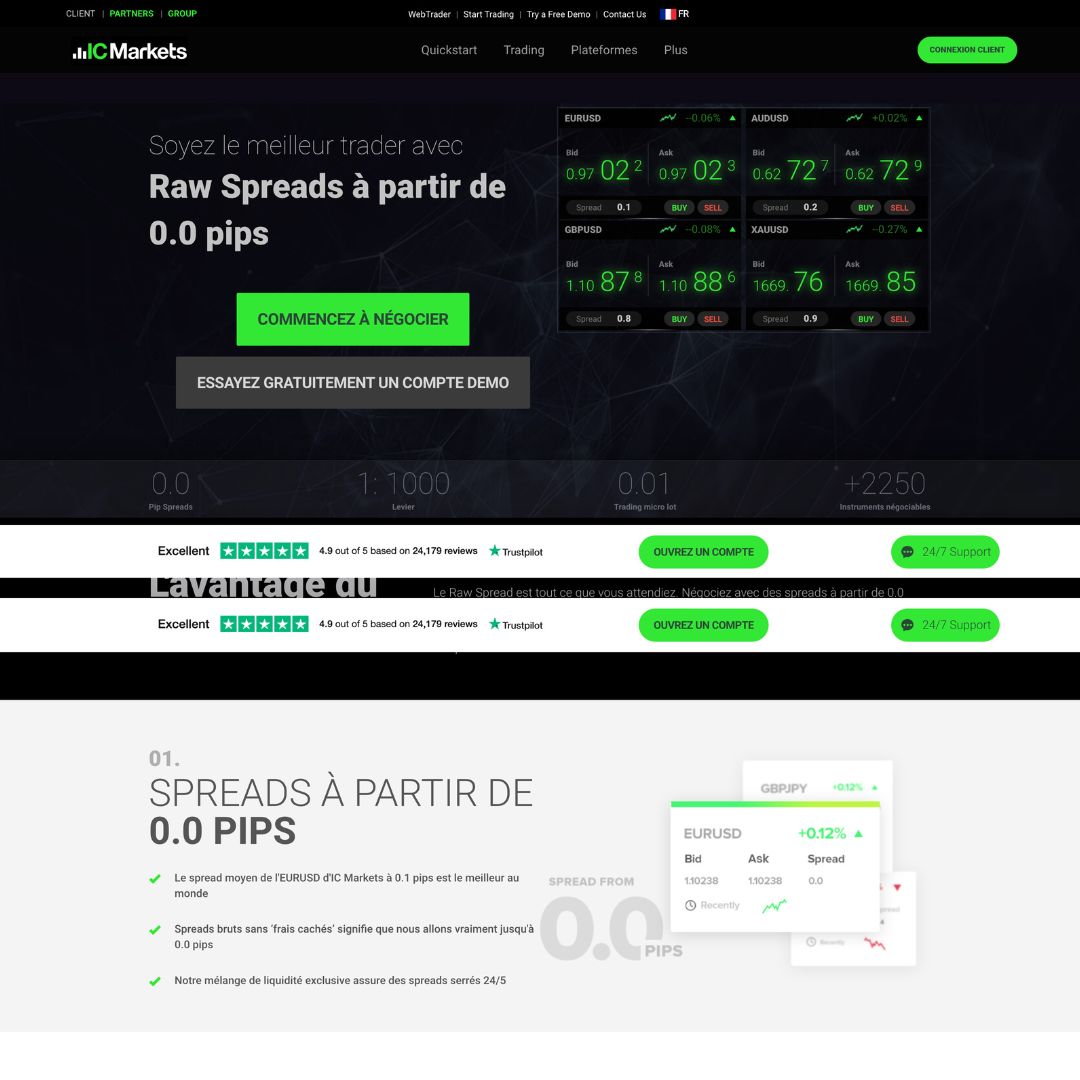

IC Markets Overview

IC Markets is regulated by the Australian Securities and Investments Commission (ASIC) and is known for offering competitive trading conditions, including low spreads, high leverage, and fast order execution through its advanced trading platforms.

The broker offers a range of trading instruments including forex, commodities, indices, and cryptocurrencies. Clients can choose between the popular MetaTrader 4 and MetaTrader 5 trading platforms, both of which are available on desktop, web, and mobile devices.

Company Details

IC Markets is regulated by the Australian Securities and Investments Commission (ASIC) and is known for offering competitive trading conditions, including low spreads, high leverage, and fast order execution through its advanced trading platforms.

IC Markets prides itself on its ECN trading environment, which allows clients to access deep liquidity from over 50 liquidity providers, resulting in tight spreads and low commission fees. The broker also offers a range of educational resources for traders, including webinars, trading guides, and market analysis.

Regulation & Reputation

IC Markets is a regulated forex and CFD broker that operates globally. The company is headquartered in Sydney, Australia and is authorized and regulated by the Australian Securities and Investments Commission (ASIC).

As a regulated broker, IC Markets is required to adhere to strict regulatory guidelines aimed at ensuring the safety of client funds and the integrity of the financial markets. Some of the key regulatory requirements that IC Markets must comply with include:

- Client money protection: IC Markets is required to keep client funds in segregated accounts, separate from its own operating funds. This helps to protect client funds in the event of the broker’s insolvency.

- Capital adequacy: Regulated brokers must maintain a certain level of capital adequacy to ensure that they are financially stable and able to meet their obligations to clients.

- Transparency: IC Markets must provide clients with clear and accurate information about its trading services, fees, and charges.

- Anti-money laundering (AML) and Know Your Customer (KYC): IC Markets is required to implement effective AML and KYC procedures to prevent money laundering and other illegal activities.

Account types

IC Markets offers a range of account types to suit the needs of different traders. Here are the main account types offered by IC Markets:

- Standard Account: This is a basic account type that is suitable for new traders. It requires a minimum deposit of $200 and offers raw spreads starting from 1.0 pips. Standard accounts can be opened in a variety of base currencies, including USD, EUR, GBP, AUD, and more.

- Raw Spread Account: This account type is designed for experienced traders who require the lowest spreads possible. Raw Spread accounts offer spreads starting from 0.0 pips, but commission fees are charged on each trade. The minimum deposit for a Raw Spread account is $200.

- cTrader Account: This account type is designed for traders who prefer the cTrader platform over the popular MetaTrader platforms. cTrader accounts offer spreads starting from 0.0 pips, but commission fees are charged on each trade. The minimum deposit for a cTrader account is $200.

- Islamic Account: This account type is designed for traders who follow Islamic principles, which prohibit the charging or paying of interest. Islamic accounts operate on a swap-free basis, and there are no rollover fees for overnight positions. The minimum deposit for an Islamic account is $200.

IC Markets also offers a demo account that allows traders to practice trading in a risk-free environment using virtual funds. The demo account is a great way for new traders to get familiar with the platform and test their trading strategies before opening a live account.

We have broken up the other fees and transaction costs a trader is likely to encounter with IC Markets and explained what these fees entail.

| Fee Type | Standard Account | Raw Spread Account | cTrader Account |

|---|---|---|---|

| Spreads | From 1.0 pips | From 0.0 pips | From 0.0 pips |

| Commission Fees | N/A | $7 per lot | $6 per lot |

| Deposit Fees | Free | Free | Free |

| Withdrawal Fees | Free | Free | Free |

| Inactivity Fees | $15 per month | $15 per month | $15 per month |

| Overnight Financing (Swap) | Yes | Yes | Yes |

| Trading Platform Fees | Free | Free | Free |

It’s safe to say that IC Markets’s fees are low in general. They either don’t charge a brokerage fee for things other brokers do charge for, or they only charge a small amount. This means that you can use IC Markets even in case you trade frequently like multiple times a week or daily.

Here’s a high level overview of IC Markets’s fees

| Assets | Fee level | Fee terms |

|---|---|---|

| EURUSD | Low | MetaTrader raw spread account: $3.50 commission per lot per trade plus spread cost. 0 pips is the average spread cost during peak trading hours. |

| GBPUSD | Low | MetaTrader raw spread account: $3.50 commission per lot per trade plus spread cost. 0 pips is the average spread cost during peak trading hours. |

| S&P 500 CFD | Low | The fees are built into the spread, 0.2 points is the average spread cost during peak trading hours. |

| Inactivity fee | Low | No inactivity fee |

Products traded

IC Markets offers a wide range of trading instruments across different asset classes. Here are some of the main products that you can trade with IC Markets:

- Forex: IC Markets offers over 60 currency pairs, including major, minor, and exotic pairs. Forex trading is available 24/5, and clients can enjoy competitive spreads and fast order execution.

- Commodities: IC Markets offers trading in precious metals like gold and silver, as well as energy products like oil and natural gas. Clients can trade these products on both MT4 and MT5 platforms.

- Indices: IC Markets offers trading in global stock market indices, including the US 500, UK 100, and Japan 225. Clients can trade these products on both MT4 and MT5 platforms.

- Stocks: IC Markets offers trading in over 120 US and Australian stocks, including Apple, Google, and Amazon. Clients can trade these products on the MT5 platform only.

- Cryptocurrencies: IC Markets offers trading in a range of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Ripple. Clients can trade these products on both MT4 and MT5 platforms.

IC Markets also offers access to the multi-asset class cTrader platform, which allows clients to trade a range of products from a single account. The cTrader platform offers trading in forex, commodities, indices, and cryptocurrencies.

Trading Platforms

IC Markets offers several trading platforms to suit the needs of different traders. Here are the main trading platforms available with IC Markets:

- MetaTrader 4 (MT4): This is the most popular trading platform offered by IC Markets. It is a user-friendly platform that is suitable for both beginners and advanced traders. MT4 offers advanced charting tools, a range of technical indicators, and automated trading capabilities through expert advisors (EAs).

- MetaTrader 5 (MT5): This is the latest version of the MetaTrader platform and offers a range of new features and improvements compared to MT4. MT5 offers more advanced charting capabilities, more order types, and improved multi-asset class support.

- cTrader: This is an advanced trading platform designed for professional traders. cTrader offers advanced charting capabilities, a range of technical indicators, and advanced order management tools. It also offers one-click trading and depth of market (DOM) pricing information.

- WebTrader: This is a web-based platform that allows traders to access their accounts and trade directly from their web browser. WebTrader offers a user-friendly interface, advanced charting tools, and a range of technical indicators.

- Mobile Trading: IC Markets offers mobile trading apps for both iOS and Android devices. The mobile trading apps allow traders to access their accounts, manage their trades, and view real-time market data from their mobile devices.

IC Markets also offers a range of trading tools and resources, including trading calculators, economic calendars, and trading signals. Additionally, IC Markets offers VPS hosting services to traders who want to run their expert advisors 24/7 without interruption.

Deposit and Withdrawal

IC Markets offers a variety of deposit and withdrawal options to make it easy for traders to fund their accounts and withdraw their funds. Here’s an overview of the main deposit and withdrawal methods offered by IC Markets:

- Bank Transfer: Traders can fund their accounts through a bank transfer, which is typically free. However, it may take several days for the funds to appear in the trading account.

- Credit/Debit Card: IC Markets accepts deposits from Visa and MasterCard credit/debit cards. The deposit fee for credit card deposits is 1.5% of the deposited amount.

- Electronic Payment Methods: IC Markets also accepts deposits through various electronic payment methods, including Skrill, Neteller, PayPal, and WebMoney. These payment methods typically have lower deposit fees and faster processing times than bank transfers and credit cards.

- Cryptocurrency: Traders can also fund their accounts with Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and Ripple.

Withdrawals can make through the same methods used for deposits. Withdrawal processing times depend on the payment method used, with bank transfers typically taking the longest time to process.

IC Markets does not charge fees for withdrawals, but traders should be aware that some payment providers may charge their own fees for processing withdrawals.

It’s important to note that the availability of deposit and withdrawal options may vary depending on the trader’s location and the account type. Traders should always check the latest deposit and withdrawal options and fees on the website.

Customer Service

Customers have described IC Markets’ customer service as excellent compared to other brokers, and it is available 24/7, which is exceptional given the norm is 24/5. In addition, traders from all over the world have access to hands-on support provided in a variety of languages. Several languages are available for customer service, including Dutch, German, English, Danish, Polish, Japanese, and Chinese.

Customer support at IC Markets is available in various channels, including phone, email, and live chat.

Conclusion

ICMarkets is a reputable exchange , licensed and regulated by the most trusted financial regulators in the World. Most importantly, as a forex trader like you, your I personally have never had any problems in both the transaction and withdrawal process.

Therefore, with the reviews from the Reviewsan.vn team, we believe that ICMarkets trading platform deserves to be one of the best choices for you.

IFAQ

Here are some frequently asked questions (FAQs) about IC Markets:

Q: Is IC Markets a regulated broker? A: Yes, It is a regulated broker. It is regulated by the Australian Securities and Investments Commission (ASIC) and the Seychelles Financial Services Authority (FSA).

Q: What trading platforms does IC Markets offer? A: It offers a range of trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, WebTrader, and mobile trading apps for iOS and Android devices.

Q: What products can I trade with IC Markets? A: It offers a range of trading instruments across different asset classes, including forex, commodities, indices, stocks, and cryptocurrencies.

Q: What are the account types offered by IC Markets? A: It offers three account types: Standard Account, Raw Spread Account, and cTrader Account.

Q: What are the minimum deposit requirements for IC Markets? A: The minimum deposit requirement for the Standard Account and Raw Spread Account is $200, while the minimum deposit requirement for the cTrader Account is $1,000.